What’s roiling the housing market? More than meets the eye

This month, The Drill Down peels back the roof to reveal the range of reasons that American housing is in such flux. What we found is a fascinating confluence of climate impact, buyer headwinds, and Boomer reluctance – all contributing to a “stuck” market. But even in this unique environment, there is opportunity for the well-informed.

When home insurance dries up: The surprising way climate risk is forcing homeowners to rethink where they live

Across the U.S., more than 11 million households have no home insurance — leaving roughly 1 in every 7 homes exposed if disaster strikes. For a growing number of homeowners, skipping coverage isn’t a careless oversight but an uneasy trade-off as insurance prices climb and coverage options disappear entirely.

Once a basic safeguard of owning a home, affordable and dependable insurance is becoming harder to find in places most exposed to climate extremes. Rising risks and an increasingly strained insurance market aren’t just driving up costs — they’re also reshaping where people believe they can safely and sensibly put down roots. More here: (Source)

The S/M Take:

Climate abandonment areas. Resilient residences. Wildfire Prepared Neighborhoods. Have any of those on your bingo sheet? You’re not alone. Climate change has rattled us all, and made many of the places where people want to live the most – Florida, California, Texas, Colorado, Hawaii – among the hardest to find insurance. The Drill Down would like to explore a solution.

Proactive fortification, as the article explains, is a set of practices to help homes withstand the forces of wind, fire and flood. These methods are a boon to the home improvement and construction industry, with wind-rated roofs, robust garage doors, and innovative construction materials (see one of our faves here) among the insurance-pleasing recommendations.

We can’t change the weather. But we can change the house.

Why the housing market is so stuck, in 4 charts

The US is in the middle of the typical peak homebuying season, but all signs suggest that the market remains sluggish.

Housing contract activity slipped sharply in April, even though buyers had more inventory to choose from. Meanwhile, buyers and sellers are locked in something of a standoff: More sellers are listing their properties, but prices haven’t fallen much, and buyers are being picky.

Yahoo Finance compiled charts that illustrate how quickly the housing market shifted in the last five years, and why it’s at a standstill now. More here: (Source)

The S/M Take:

At The Drill Down, we love us some metrics – even the tough ones. In this case, it’s helpful to see how the interplay of data has led to a gummy housing market (albeit one with massive breakout potential).

While there are plenty of headwinds, there is plenty of hope: Grudging acceptance of 7% mortgages, rising inventory, and moderating prices among them. Until the bounce, read below for other marketing moves you can make today.

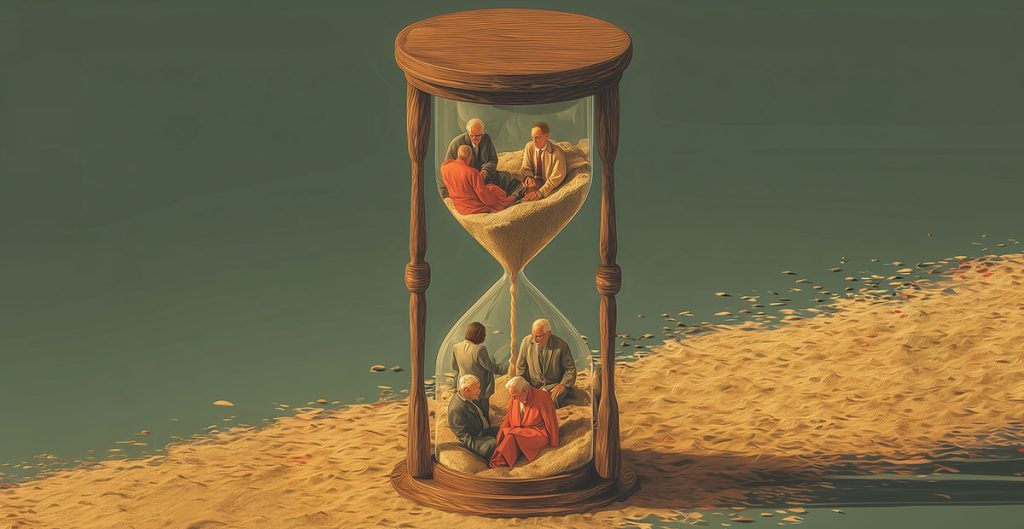

The Baby Boomer housing crisis: Why seniors are downsizing too late

For decades, Baby Boomers helped drive the American dream of homeownership. Large homes with multiple bedrooms, lush lawns, and garages packed with memories became the reward for a life of hard work. But now, as millions of Boomers reach retirement age, that dream is turning into a burden, and for many, a ticking financial and logistical time bomb.

With health challenges, shifting finances, and a lack of planning, many seniors are finding themselves stuck in homes that are too big, too costly, and too difficult to maintain. The result? A crisis that affects not just the Boomers, but their children, the housing market, and the broader economy.

Here’s why downsizing later is becoming a dangerous trend, and what families need to know now. More here: (Source)

The S/M Take:

Boomers are effectively the cork in the housing bottle. As noted in the preceding story, they are hunkered down in low-interest mortgages and aren’t moving. That freezes out the aspiring, expanding families behind them, and ghosts the downsized homes that would normally be in their future.

For marketers, just because there’s little movement doesn’t mean there’s little opportunity. Stay-put Boomers will retrofit to age in place; stuck Millennials will add on where they are. Let’s meet these cohorts where they are today, with products and services unique to these moment-in-time challenges.

Subscribe to the

DRILL DOWN

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.